If you own a structured settlement, there are a number of ways you can profit from it. You can sell it to someone else for cash or you can take advantage of it by using a structured settlement calculator.

The reason that people buy structured settlements is that they feel that they will be able to receive a lump sum payout. A lot of people feel that they will have to wait years before they can receive the cash and they aren’t able to plan their life around that scenario. The idea of receiving a lump sum is very appealing.

When you use a structured settlement calculator, you can calculate what your future cash earnings will be with regards to your scheduled annuity. It helps you determine if it is better to invest the cash in an annuity or to keep the money as a lump sum.

Using a structured settlement calculator will also help you see if it is better to receive the cash now or wait until later. Some people like to use their structured settlement because they think they may need it in the future, but when you factor in that the annuity will only pay you if you need it in the future, the possibility of never receiving the cash makes them feel better.

When you are considering an annuity, you might want to consider whether or not it would be a better option for you to invest the money today or take a loan against it. The amount you need to borrow is going to be different for everyone and you should make sure that you are ready for the lump sum you are going to receive when you sell your structured settlement.

You might consider making payments over a number of years instead of getting a large cash amount in the near future. That way, if something happens to you while you are waiting for your annuity, you would be well protected.

Many people like the idea of receiving an immediate lump sum when they use a structured settlement calculator. They like the idea of receiving a cash payout without having to work for years on the same thing. You might want to consider the fact that you will still have to pay taxes on any lump sum received.

There are times when people buy a structured settlement so that they can receive a large lump sum of cash immediately. This is an understandable reason and it could make sense for some people. On the other hand, if you have a large amount of money in a structured settlement, you may have to continue paying it to avoid taxes.

The amount of money you are going to receive from selling a structured settlement will depend on several factors. For example, the value of the settlement might be lower than you expected and you might find that you receive less than you expected.

If you are planning to use a structured settlement calculator, you can change your expectations as often as you want. You will find that you get good value from the annuity if you choose to sell it when you get older.

You will find that using a structured settlement calculator can be very helpful. It can help you decide whether or not it is better to cash out now or hold onto it until you are ready to take advantage of it.

You can find a lot of information about a structured settlement calculator at various places online. Take some time to explore the possibilities and find out more about what you can do with a structured settlement.

Tag Archives: structured settlement

Annuity Payment Calculator

If you are planning to invest in annuities, a helpful option is to use an annuity payment calculator. With this tool, you can calculate the amount of monthly payments that you can expect to receive as your annuity payments accumulate. Once you know what to expect, you can prepare accordingly. |

|

The first step to preparing for your annuity payments is to calculate how much of your salary you should leave as a return on your investments. In most cases, this amount will be a significant part of your total annuity payments. Depending on your job and the type of annuity you choose, you may be able to receive an additional return on top of the salary that you leave as a return on your investments.

When you know how much money you can afford to leave as a return on your investment, you can allocate it to your future income stream. You may want to consider saving a percentage of your salary as an annuity payment to provide a cushion to protect against unforeseen circumstances.

Another important factor when preparing for your annuity payment is to pay attention to the exact investment options available to you. There are two major types of annuities available, variable annuities and fixed annuities. Which one you select will depend on your financial situation.

Variable annuities provide an investor with a certain amount of returns and allow the investor to choose the rate of return that he or she wants. For example, a variable annuity that pays a higher rate of return allows the investor to earn more money over time. On the other hand, if you chose a variable annuity that did not offer a high return, you would be receiving an equal amount of annuity payments over time.

Fixed annuities are another option, but they do not allow you to choose the rate of return that you would like. Instead, these annuities allow the investor to lock in a set rate of return. This rate of return remains the same and the annuity is guaranteed to provide a return.

Once you have an idea of how much money you can afford to leave as a return on your investment, you need to calculate how much of your salary you should leave as an annuity payment. It is important to understand that a variable annuity provides a greater return than a fixed annuity. The variable annuity offers an adjustable return; therefore, the amount of annuity payments will change depending on the performance of the market. However, a fixed annuity gives you a fixed rate of return.

Once you know how much money you can afford to leave as an annuity payment, you can now focus on the details of the investment options available to you. One of the most important decisions you will make is the type of annuity you choose. For those who prefer to invest in bonds, there are a number of fixed annuities available.

While fixed annuities do not provide an additional return to an investor, they do ensure that you are receiving a regular stream of income. Also, fixed annuities offer lower expenses. With fixed annuities, your initial investment costs are eliminated.

The only downside to fixed annuities is that they usually require a longer time period to pay off. In addition, variable annuities are slightly less expensive than fixed annuities. Many investors find the variable annuity a more attractive option.

The amount of money that you invest in these annuities will depend on your income level and available options. If you cannot invest enough money to cover your investment needs, it is possible to convert your investment from fixed annuities to a variable annuity. In this case, the monthly payments from the variable annuity will be used to offset the returns from the fixed annuity.

Regardless of which type of annuity you choose, a valuable tool for investors is an annuity payment calculator. The money you receive from annuities is tax-deferred. as long as you are age 55 or older, and you may qualify for both a standard and a Roth annuity.

Should I Sell My Retirement Annuity Payments?

In this article I want to answer the question, “Should I sell my retirement annuity payments?” As with any important financial decision, it is a good idea to seek a financial advisor or knowledgeable financial advisor’s advice before making a decision. Below I have included three questions that will help you make an informed decision about selling your retirement annuity payments. |

|

Before you decide to sell your retirement annuity payments, you should first find out how much money you are going to get. You can find out this information by getting a free copy of your existing pension statements. If you have a large amount of money in your pension account, then you will have a better chance of being able to sell your annuity payments.

It is also a good idea to get a lump sum amount as soon as possible. The reason for this is that there is a very high possibility that your current retirement annuity will convert to a single lump sum payment. With this option, the money you get from selling your pension annuity payments will be taxed as ordinary income and you will only receive the tax benefits after you have earned a specified number of years of pension income. You can save yourself time and money by taking advantage of this option.

Many people believe that selling their retirement annuity payments is never an option. However, many of these people did not carefully weigh the costs and benefits of retirement annuities before choosing to purchase the annuity. Others made the wrong decision based on the price of the annuity.

It is possible that if you want to sell your pension payments, you may be offered a lower annuity price than what you wanted to pay. However, it is very important to take into consideration how long it will take you to earn the amounts that you are currently receiving. In the meantime, you could lose money when sellingyour annuity.

Many people do not realize the importance of an immediate annuity income. When you need the money now, you will be glad you have started saving early. When you need to save your money for a rainy day, annuities are a great way to do it. There are some who feel that you should never sell your annuity because it is difficult to make a lump sum payment and because your annuity will most likely continue to compound interest for the rest of your life.

A more realistic approach is to ask yourself if you really need the money that you are currently receiving from your annuity payments. If the answer is yes, then you can consider selling your annuity. However, if the answer is no, then you should consider the benefits of living in a retirement plan that allows you to enjoy your money for years to come.

There are two reasons why some people prefer to get their annuities in the form of a regular single lump sum payments. First, these payments offer better tax benefits.

Second, since there is no reinvestment option with annuities, they allow a person to save more tax money than regular income. This allows a person to make more money with a single lump sum payment, but it also allows a person to save money in the long run because of tax savings.

Even if you end up earning more money from your regular annuity payments, you may still be eligible for tax incentives. You might qualify for a deduction on your taxes for the amount of your regular annuity payments you receive. This is especially true if you invested a large amount of money in your annuity.

If you have decided to sell your annuitypayments, you will want to make sure that you consider your whole life and retirement plans before deciding on whether to sell your retirement annuity. You should know that the amount of your annuity payment will affect your lifetime income even though you are only receiving a fraction of that income.

If you want to sell my retirement annuity payments, there are a number of companies that offer annuity buy-sell contracts. You can use this option to find out if you can sell my annuities for a profit.

Selling Your Annuity Settlement

When your circumstances change, sometimes selling your annuity or insurance settlement can help you get back on track.

What Is A Structured Settlement?

SSC Video

My Structured Settlement Cash video…

Let us know what you think!

Selling a Structured Settlement

Structured settlements are not something that most people are seeking. The thought of receiving an unexpected annuity (a prearranged sum to be paid out annually) in addition to a regular income is certainly compelling. But the fact that you must suffer a serious incident or accident that results in long-term injury or illness in order to qualify for such a settlement makes the prospect far less appealing. And yet, if you have been the victim of such unfortunate circumstances, you definitely want some kind of settlement to ensure that you don’t spend the rest of your life saddled with medical bills that you can’t hope to pay (in addition to your ongoing pain and suffering). Of course, many people hope for a lump sum that they can do with as they wish. But many judges see fit to offer a structured settlement instead as a way to maximize the payout (often by reducing taxation through a deferred payment plan) and protect injured parties from themselves (whether justifiably or not).

Structured settlements are not something that most people are seeking. The thought of receiving an unexpected annuity (a prearranged sum to be paid out annually) in addition to a regular income is certainly compelling. But the fact that you must suffer a serious incident or accident that results in long-term injury or illness in order to qualify for such a settlement makes the prospect far less appealing. And yet, if you have been the victim of such unfortunate circumstances, you definitely want some kind of settlement to ensure that you don’t spend the rest of your life saddled with medical bills that you can’t hope to pay (in addition to your ongoing pain and suffering). Of course, many people hope for a lump sum that they can do with as they wish. But many judges see fit to offer a structured settlement instead as a way to maximize the payout (often by reducing taxation through a deferred payment plan) and protect injured parties from themselves (whether justifiably or not).

Top Three Reasons to Sell a Structured Settlement

Why does a person receive structured settlement? It usually comes down to 2 reasons, either a personal injury or product liability.

This is a financial and legal agreement between the defendant and the plaintiff which refers to periodic payments aimed to be compensation for the injury. The plaintiff is offered structured settlement once the defendant’s attorney becomes sure of the fact that there’s no winning the lawsuit and it’s in the best interest of the defendant that a mutual settlement is finalized. As a result a huge amount of money is awarded to the plaintiff, which they receive as periodic annuity payments from an insurance agency (at times broker).

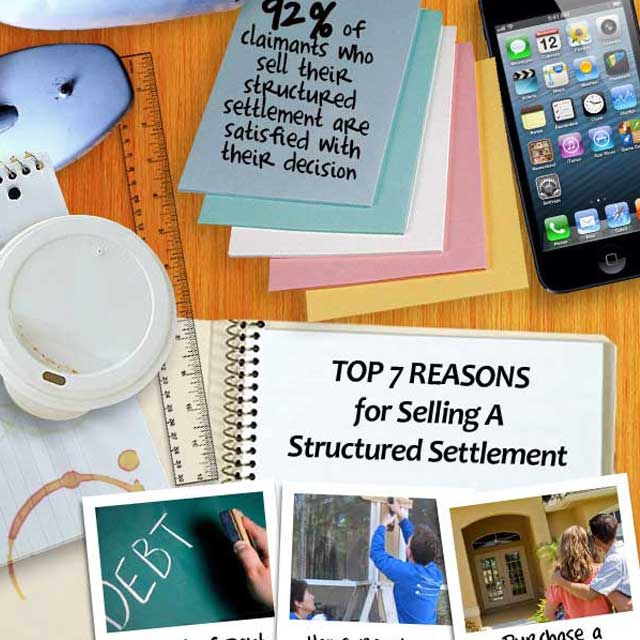

Now, the question is what may have induced you to start considering a cash-out. Though there are many advantages of holding on to structured settlements, most of the plaintiffs are selling off their structures in return of an attractive lump sum which makes it easier for them to take care of a number of responsibilities which expenditures and/or investments. Annuity payment from structured settlements may be a huge support for some who need a steady source of income for their lifetime but the lump sum can benefit you in a number of ways as well. Let’s take a look at what some of the most popular reasons to selling a structured settlement are today.

Selling structured settlement – win some and lose some!

Structured settlements offer a plaintiff the flexibility to decide whether they want to continue with the periodic annuities or they want to go for cash-out. Considering that you need immediate cash and are thus looking to sell your structured settlement, the first question that will definitely come to your mind is this – How much can I get for my structured settlement?

Well, a number of factors will be at play. And, it is a combined effect of all these factors that will decide how much you will be able to get. There are, however, a few things to consider such as:

- The total value of the settlement

- Rate of discount at which you will be selling off your structured settlement

- The number of payments you are yet to receive (that’s considering you have decided to get cash out for a part of the settlement amount)

While in case of annuities you would have received settlements at their pre-tax value amounting to the total amount which was initially decided, in case of cash out you need to be ready to ‘part’ with a ‘part’ of the total settlement amount! The factoring company will buy your structures, not at their original value but at a discounted rate. This is where you lose out. The cash out process usually takes up to 90 days to be cleared. So, you need to be prepared for that too.

Another scenario may arise while selling your structured settlement. Let’s suppose you have already sold a part of it earlier, so can you sell the remaining portion now? Yes, that’s possible too. This, again, depends on the amount of the settlement amount left. You need to furnish to details of your settlement to the factoring company and see if they agree to the process or not. The factoring companies buy the structure from you at a profit, depending on the rate of interest at which you are required to sell your structures. Finding a factoring company isn’t at all difficult at present, what’s tough though is to find one that delivers according to the assurances. That’s where My Structured Settlement Cash comes in, we make it easy to get the best quote available.