Estimating The Present Value Of An Annuity Settlement

Insurance annuities and structured settlement values are based on a number of criteria, but one of the most important considerations is the health of the insurance company that stands behind the policy.

Often regarded as the discounted rate, factoring of the discounted present value is calculated by dividing the purchase price of an annuity settlement by the discounted present value.

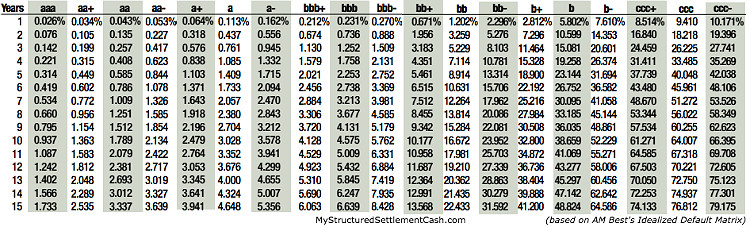

As you can see from the following chart, the length of time to collect the annuity/settlement also affects the value. The longer the duration, the more risk that's involved. While a rating might be favourable now, there's no guarantee of the future of an insurance company.

The most common agencies that provide ratings include Standard & Poor's (S&P), AM Best, and Moody's.

Determining the present value (PV) of a structured settlement is not an easy process and takes into account a large variety of factors to determine the worth based on several variables. Some of the main points include the amount of the annuity settlement, the duration of payments, the frequency of payments, how much was paid in the past, and the insurance company behind it.

The best way to find out what your settlement might be worth would be to try our calculator for an idea of it's worth. For a more accurate quote, simply continue with the process to have a representative contact you for more details.

Also see:

How Much Is My Structured Settlement Worth?

Wikipedia: Structured Settlement Factoring Transactions - Discounted Present Value